estate tax change proposals 2021

For married couples this threshold is doubled meaning they can protect up to 234 million in 2021. What you need to know about the proposed estate and gift tax changes in 2021 Due to the spending spree brought on by the COVID-19 pandemic and President Bidens infrastructure building plans it is no surprise that Congress is focusing on increasing revenue.

Estate and gift tax exemption.

. On September 13 The Ways. Most of the time these proposals include suggestions for collecting more tax. The exemption is unlimited on bequests to a surviving spouse.

Then the gift and estate tax exemption is lowered from 117 million to 35 million with the gift and estate tax rate increased from 40 to 45 all retroactively effective January 1 2021. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals.

Replace the 20 long-term capital gains tax with a 25 rate where total taxable income exceeds. From 50 million-1 billion. Theres still a chance to reduce taxable estate as part of overall estate planning and tax planning strategies.

And while the gift and estate tax exemption is scheduled to drop to approximately one-half the current amount on January 1 2026 there also are tax proposals in play that could change the estate and gift tax laws much sooner. As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US. Net Investment Income Tax would be broadened to cover more income if your total income was greater than 400000.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Thankfully under the current proposal the estate tax remains at a flat rate of 40. The proposal in Congress would cut the federal exemption in half.

If both spouses made equal gifts of. November 16 2021 by admin. In 2021 we have some major overhauls to tax and estate law including the expiration of many pandemic-related credit and assistance programs.

Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. Under current law the estate tax on a net taxable estate of 11700000 will be zero. If an estate contains assets in excess of the exemption amounts those assets will be taxed at rates ranging from 45 to 60 the current top estate tax rate is 40.

The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation. If the exemption is decreased from 117 million to 35 million and the estate tax rate is raised from 40 percent to 45 percent the cost. Potential Legislative Tax Changes With Greatest Impact on Wealth Transfer.

What was considered a tax-free gift on August 1 2021 now becomes a taxable gift and incurs gift tax of 3690000. Unrealized gains would be taxed when assets transfer at death or by gift as if they were sold. July 13 2021.

This last week House Democrats released details of a new tax proposal to support the 35 trillion. 5376 by Congressman John Yarmuth. Decrease of Estate and Gift Tax Exemption.

Current Estate Tax in 2021 Proposed Changes In 2021 the threshold for federal estate taxes is 117 million which is slightly up from the 1158 million in 2020. As a result of the proposed tax law changes families small business owners and others may want to take advantage of the current 117 million gift tax exemption before the end of 2021. The current 2021 gift and estate tax exemption is 117 million for each US.

The gift estate and GST generation skipping transfer tax exemptions are 117 million per person adjusted for inflation. Effective January 1 2022 these exemptions will decrease to 5 million per person adjusted for inflation from 2011. Heres everything you need to know about the Biden estate tax exemption 2021 plan.

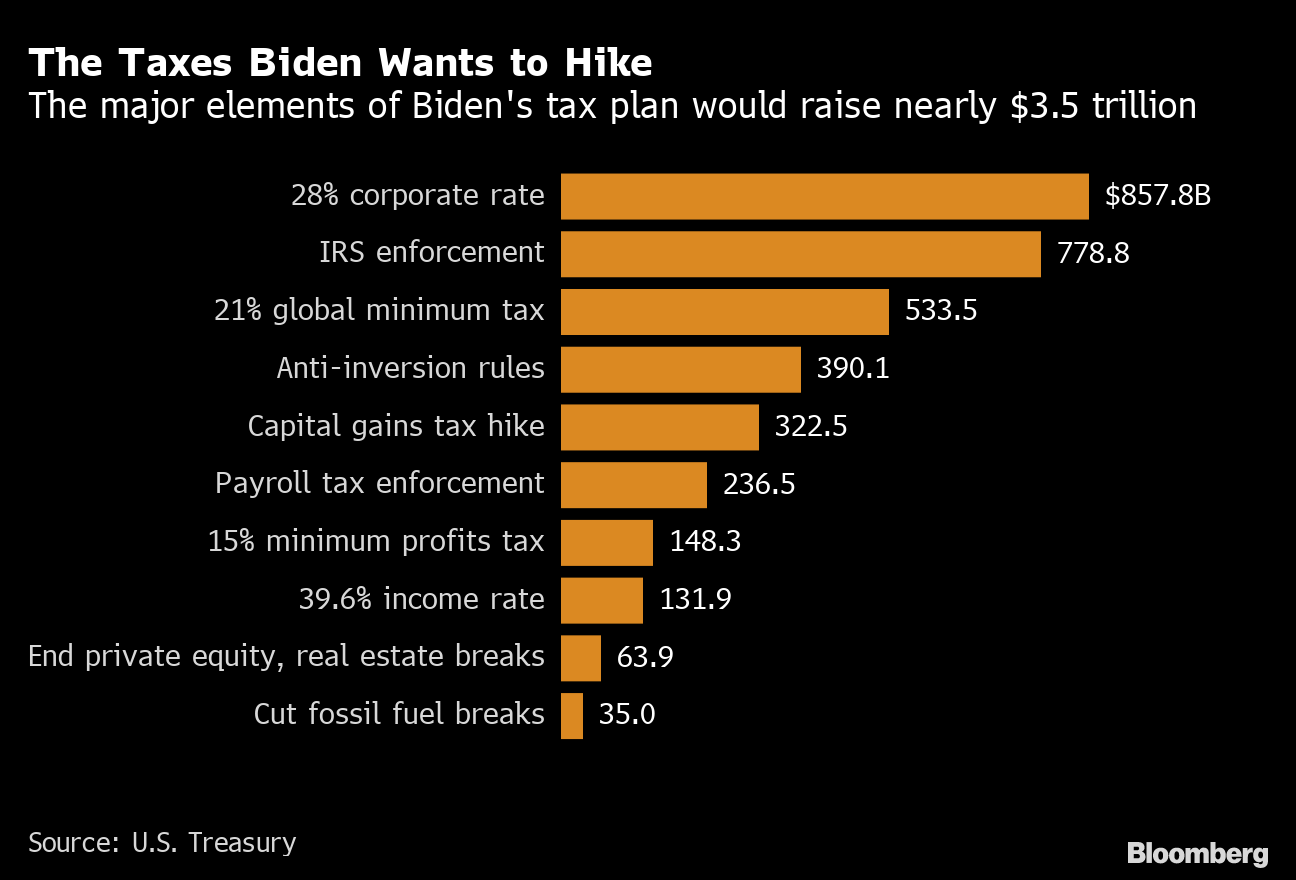

Proposals to decrease lifetime gifting allowance to as low as 1000000. Capital gains tax would be increased from 20 to 396 for all income over 1000000. Bureau of Labor Statistics Consumer Price Index.

PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021. On the campaign trail then-candidate Biden expressed a desire to reduce the gift and estate tax exemption from. Proposed Changes On September 27 2021 the Build Back Better Act was introduced into the House of Representatives as HR.

The effective date for this increase would be September 13 2021 but an exception would exist for gain recognized. While campaigning President Joseph Biden proposed lowering the current 117 million exemption amount to 35 million per individual and increasing the estate tax rate from 40 percent to 45 percent on amounts exceeding the exemption. However on October 28 and then again on November 3 the House Rules Committee released revised proposals after substantial congressional negotiations.

If passed both the federal and New York estate tax exemptions for 2022 would be about 6 million. From 35 million-10 million. What are the proposals.

Decrease in the Gift Estate and GST Tax Exemptions Current law. Biden tax proposal impact on estate planning. The current 2021 gift and estate tax exemption is 117 million for each US.

Here well summarize some of the major tax and estate law changes for the year and what we. The Biden Administration has proposed significant changes to the income tax system. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011.

The proposed bill seeks to increase the 20 tax rate on capital gains to 25. The Biden estate tax exemption 2021 plan has several changes that if enacted into law could impact how high net worth individuals pass on assets for generations to come. On September 21 2021 the House Ways and Means Committee the House released a comprehensive draft of the proposed statutory tax language the House Proposal which if enacted could take effect by January 1 2022 or theoretically earlier and have a major impact on future estate planning.

This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000 per person for transfers occurring after December 31 2021. Estate Tax Proposal 2021. With any new presidential administration come new financial priorities and the Biden administration has been no exception.

How The Tcja Tax Law Affects Your Personal Finances

How Tax Rates In Canada Changed In 2022 Loans Canada

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Democrats Might Not Touch These Taxes But They Re Going Up Anyway

Cash Rich States Are Slashing Taxes Amid Revenue Windfalls

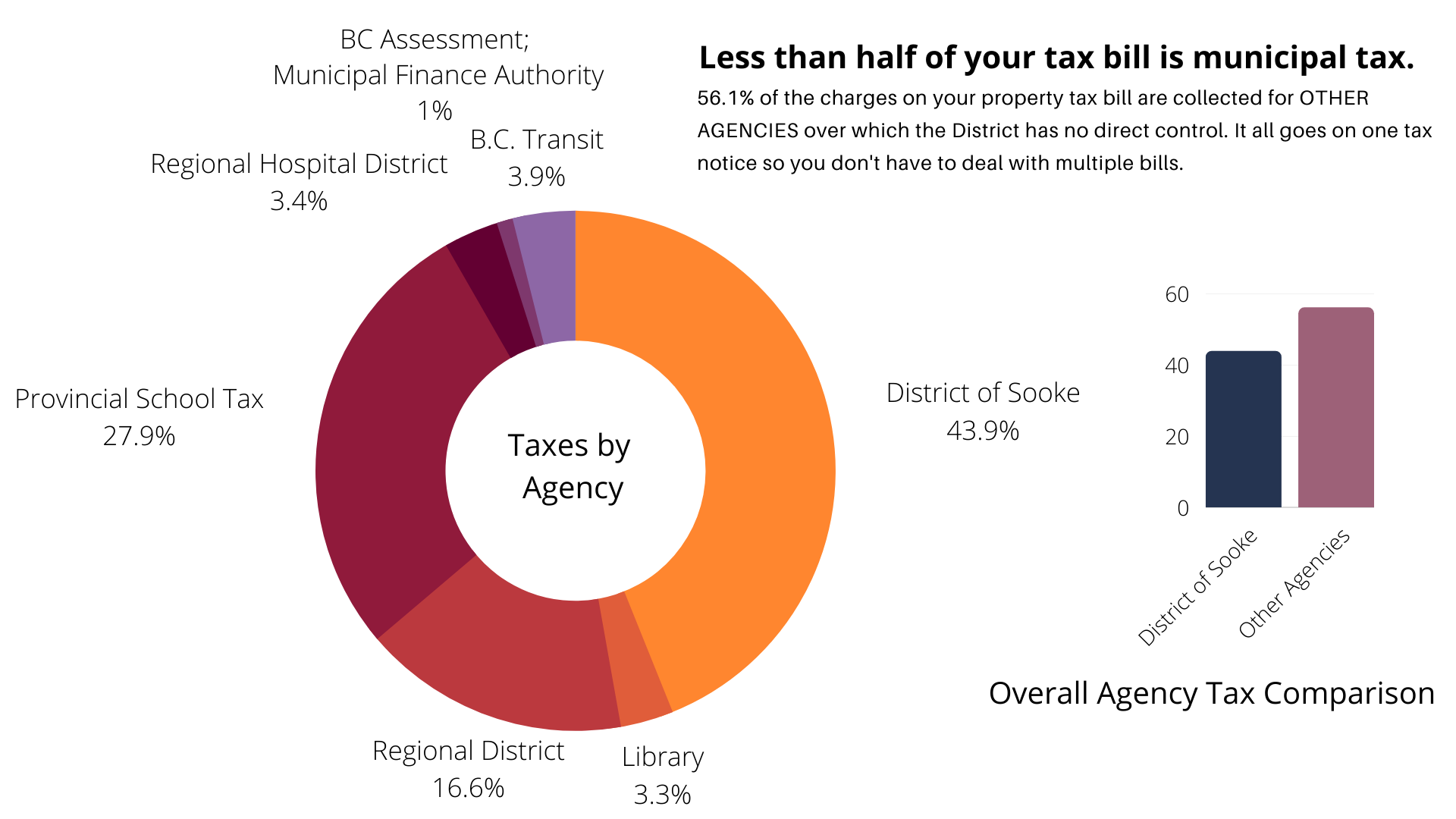

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

Comparing Property Tax Systems In Europe 2021 Tax Foundation

High Income Earners Need Specialized Advice Investment Executive

The Montreal Stm Metro Map Of 2054 Metro Map Map Montreal

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

State Corporate Income Tax Rates And Brackets Tax Foundation

What Could A New System For Taxing Multinationals Look Like The Economist

What Could A New System For Taxing Multinationals Look Like The Economist

Last Dates For Filing Gstr 3b Without Late Fee And Interest Last Date Dating Filing

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

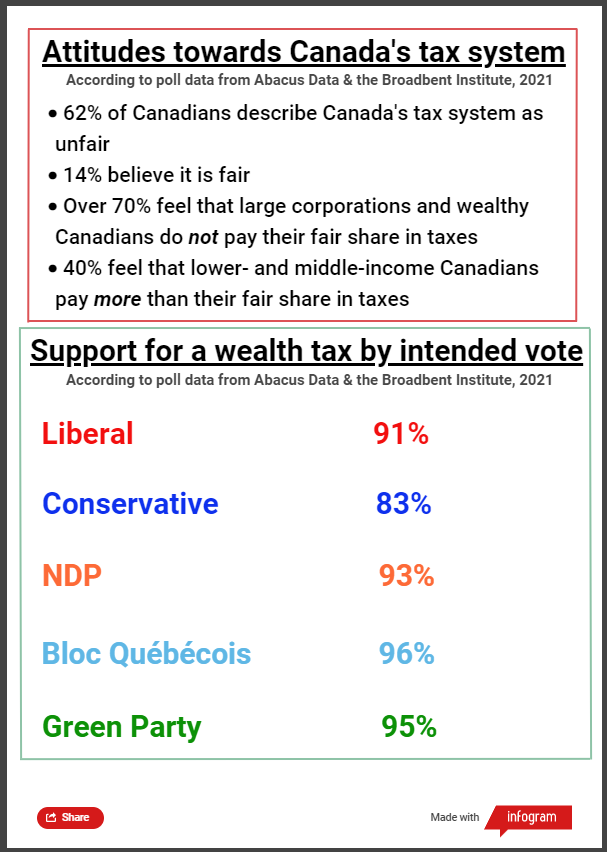

Canadians Want A Wealth Tax And Are Willing To Vote For It Canada S National Observer News Analysis