tax deductions for high income earners 2019

How To Reduce Taxable Income For High Income Earners In 2021. For 2018 the maximum elective deferral by an employee.

Personal Income Tax Brackets Ontario 2020 Md Tax

Important figures for 2022 include the following.

. Long-term capital gains tax rates are zero 15 percent and 20 percent for 2018 depending on your income. File Your California Tax Return Online with freetax USA. If youre 50 or older the limit is 6500.

The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions that affect the high income earners retirement planning and tax planning strategies. Whereas that deduction used to be unlimited its now capped at 10000 a year. This means that many individuals may find it more beneficial to take.

Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners. Tax deductions for high income earners 2019 Friday June 17 2022 Edit. Ad Free prior year federal preparation.

Understand The Major Changes. Then came the SECURE Act and Taxpayer Certainty and Disaster Tax Relief Act of 2019. Prepare your 2019 California state return for 1799.

Contributions to a qualified retirement plan such as a traditional 401 k or 403 b. Tax deductions for high income earners 2019 Saturday February 12 2022 Edit. Tax deductions for high income earners 2019 Tuesday June 14 2022 Edit.

The age for Required Minimum Distributions RMDs from retirement accounts was. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding soon to avoid an unexpected tax bill or penalty when they file their 2018 federal income tax return in 2019. One of these changes is that TCJA nearly doubled the standard deduction for most taxpayers.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan Share this post. Now in 2022 a higher standard deduction of 12950 for individuals and 25900 for joint filers.

Premium Federal Tax Software. 5 Outstanding Tax Strategies For High Income Earners Itemized Deduction Who Benefits From Itemized Deductions. The SECURE ACT makes a number of significant modifications that have an impact on high-income earners tax minimization tactics.

The SECURE Act. The required minimum distributions RMDs age was increased from 70-12 to 72 in 2020. Learn More At AARP.

Tax deductions for high income earners 2019 Saturday February 12 2022 Edit. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. Newer Post Older Post Home.

In 2019 that rises to 6000 and 7000 respectively The limits for 401 ks are much higher. IRS Tax Reform Tax Tip 2019-28 March 21 2019. Nevertheless if you hit 70-12 in 2019 you still had to begin taking RMDs in 2020.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. It would look like the following. For instance the.

PdfFiller allows users to edit sign fill and share their all type of documents online. The Tax Cuts and Jobs Act the tax reform legislation passed in. The contribution you will make.

The next two largest deductions claimed by high-income households in 2014 were the charitable deduction 108 billion and the home mortgage interest deduction 63 billion. 50 Best Ways to Reduce Taxes for High Income Earners. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

Tax law changes in the Tax Cuts and Jobs Act affect almost everyone who itemized deductions on tax returns they filed in previous years.

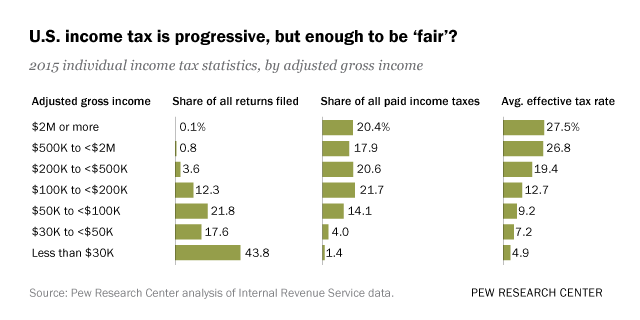

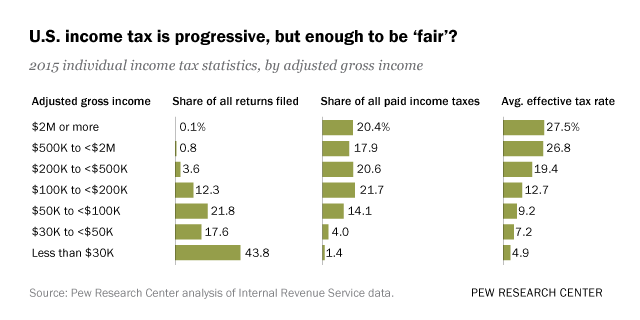

Who Pays U S Income Tax And How Much Pew Research Center

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Average U S Income Tax Rate By Income Percentile 2019 Statista

How Do Taxes Affect Income Inequality Tax Policy Center

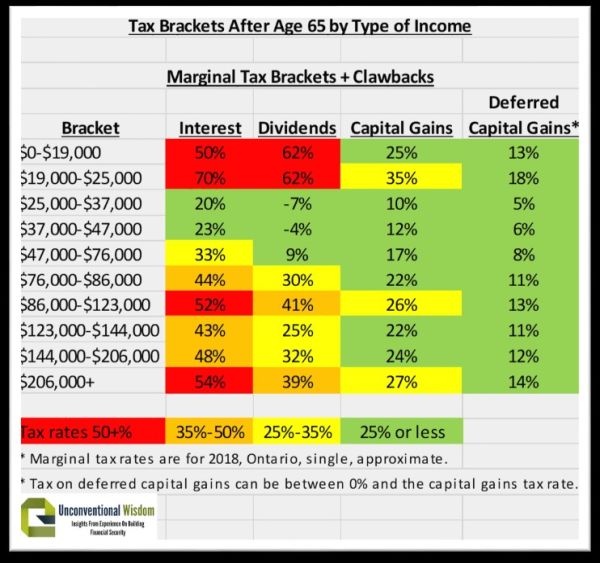

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Who Pays U S Income Tax And How Much Pew Research Center

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

Personal Income Tax Brackets Ontario 2021 Md Tax

How Fortune 500 Companies Avoid Paying Income Tax

Working Income Tax Benefit Recipients In Canada

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Medical Doctor Tips For Tax Bracket Planning

Publication 590 B 2019 Distributions From Individual Retirement Arrangements Iras Internal Revenue Ser Online Dating Apps Best Dating Apps Dating Quotes

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmiam Small Business Tax Business Tax Llc Taxes

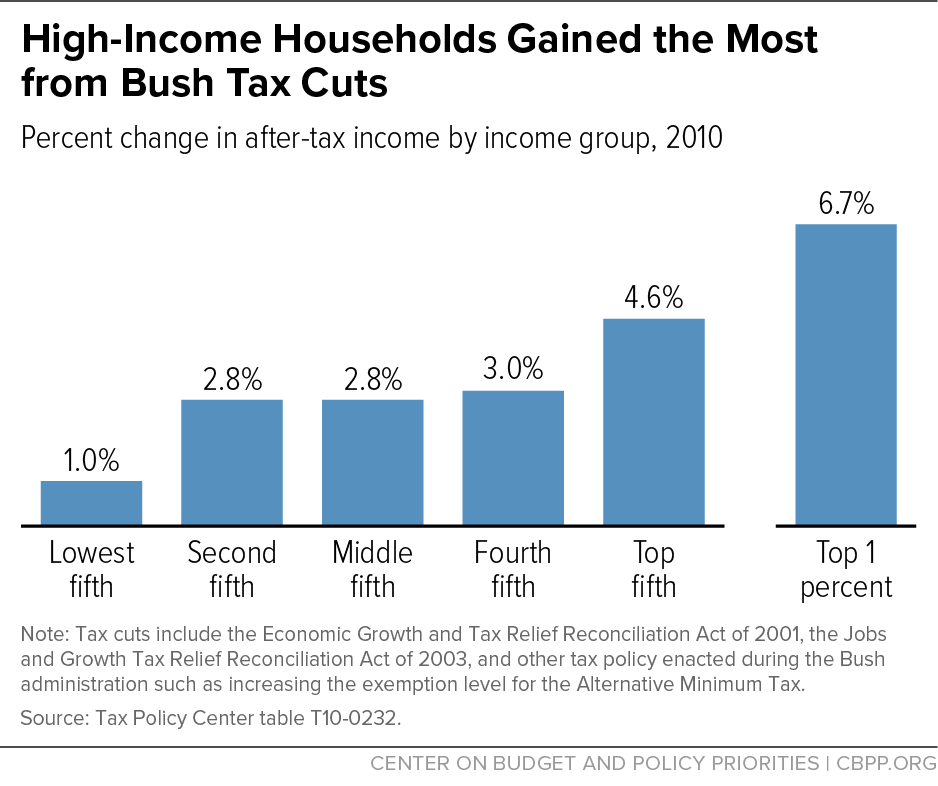

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Go After Top Income Earners With A New Tax Bracket Opposition Urges P E I Government Cbc News